21+ Irs Installment Agreement While In Chapter 13

Apply For Tax Forgiveness and get help through the process. Income you report on Schedule E may be qualified business income and entitle you to a deduction on Form 1040 1040-SR or 1040-NR.

Can I Set Up A Payment Plan With The Irs For Taxes Owed After Filing Chapter 13 Legal Answers Avvo

Section 179 deduction dollar limits.

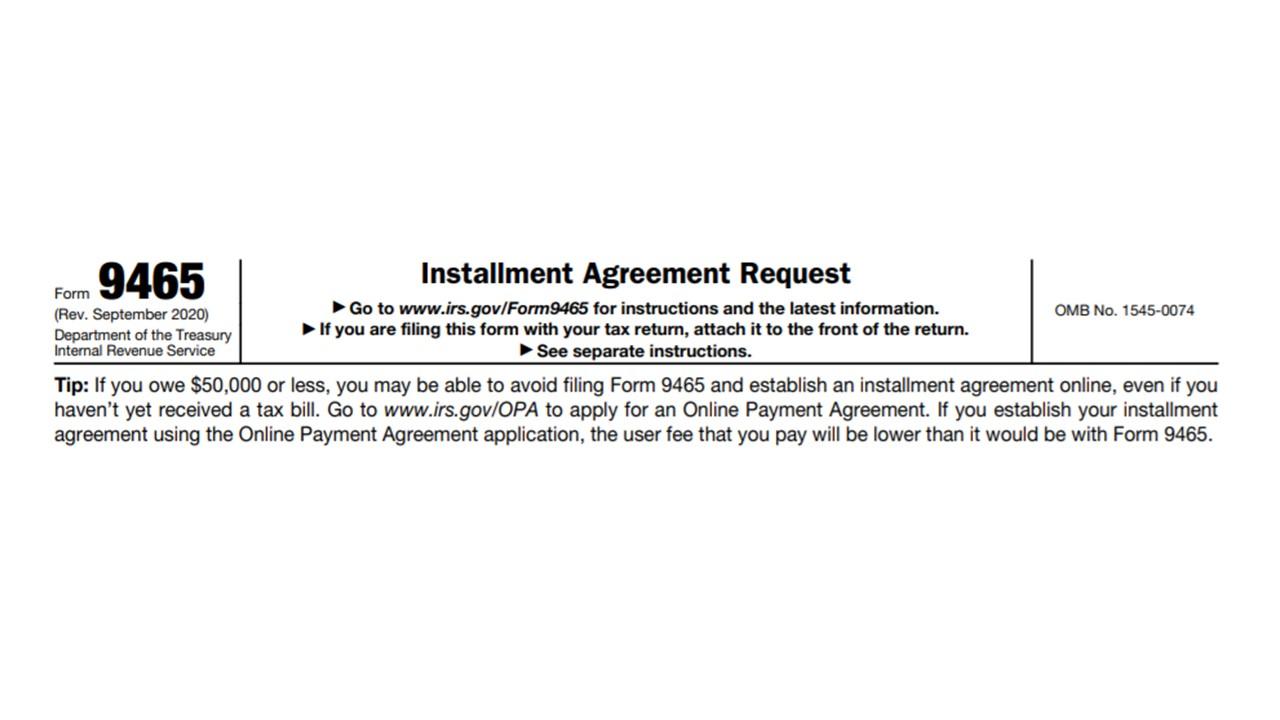

. Installment Agreement Request POPULAR FOR TAX PROS. Free competing quotes from the best. AmendFix Return Form 2848.

The caller requests information on an AUR. Also keep in mind the items under Whats New for 2022 earlier. We welcome your comments about this publication and suggestions for future editions.

Courts Bankruptcy Basics Web page. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. This IRM provides instructions to all Customer Service Representatives and Taxpayer Assistance Center functions who address various Refund Inquiries and procedures to be followed when responding to refund inquiries from taxpayers in performance of their daily duties.

IRC 6511 Limitations on Credit or Refund. 29 IRM 2153413 - IPU 22U0724 issued 06-15-2022 - Added reference to ProcessingReprocessing CIS cases. Installment Agreement Request POPULAR FOR TAX PROS.

2017-16 until December 31 2022 or the publication of another revenue procedure that supersedes all or part of Rev. IRC 6501 Limitations on Assessment and Collection. Installment Agreement Request POPULAR FOR TAX PROS.

And in IRM 321263 IRS Individual Taxpayer Identification Number ITIN Real Time System RTS. Individual Tax Return Form 1040 Instructions. See chapter 5 How To Get Tax Help for information about getting these publications and forms.

Get the Help You Need from Top Tax Relief Companies. See IRM 2121481 IRS Direct Pay for further information. NW IR-6526 Washington DC 20224.

It would be helpful for you to have a copy of your 2021 tax return and an estimate of your 2022 income nearby while reading this chapter. 30 IRM 2153414 - IPU 22U0528 issued 04-22-2022 - Added clarification for May Department Store and Sequa Underpayment Interest Issue where the taxpayer used the annualized installment method for determining the estimated tax liability. The IRS will treat a participating FFIs continued registration as its agreement with the terms of the FFI agreement contained in Rev.

You can receive tax refunds while in bankruptcy. Before providing TDS Letter 3538 verify there is a posted EIP return. Ad Get prequalified for an IRS Fresh Start Program.

AmendFix Return Form 2848. Dont Let the IRS Intimidate You. Heshe is a qualifying person for part of the year heshe was under age 13.

Line 7 If you received a distribution in 2021 from a traditional SEP or SIMPLE IRA and you also made contributions for 2021 to a traditional IRA that may not be fully deductible because of the income limits you must make a special computation before completing the rest of this form. B Numbering 1 FAR provisions and clauses. Ad You Dont Have to Face the IRS Alone.

Subpart 522 sets forth the text of all FAR provisions and clauses each in its own separate subsection. Instructions for Form 1040 Form W-9. Federal Tax Refunds During Bankruptcy.

Added citations concerning state non application of fraudulent conveyance to marital agreements. IRM 21634213 Economic Impact Payments has information about the Coronavirus Aid Relief and Economic Security Act CARES Act and payment. While many topics are touched upon in this chapter comprehensive guidance about all of them cannot be included here.

Ad Make Monthly Installments With An IRS Gov Installment Agreement. Follow ITIN procedures in IRM 3212638 Accounts Management AM. Get Free Competing Quotes For IRS Fresh Start Program.

For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. AmendFix Return Form 2848. Customer Account Services Chapter 4.

End Your Tax NightApre Now. POPULAR FORMS. Get the Help You Need from Top Tax Relief Companies.

We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Finally this publication contains worksheets to help you figure the amount of your deduction if you use your home in your farming business and you are filing Schedule F Form 1040 or you are a partner and the use of your home resulted in unreimbursed ordinary and necessary expenses that are trade or business expenses under section 162 and that you are required to pay under the.

Refer to IRM 21634213 Economic Impact Payments to identify these returns. IRM 217 Business Tax Returns and Non-Master File Accounts. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021.

Moved and revised content from IRM 25181225 to IRM 2518413 Mortgage Reduction and Other Tracing Issues. IRM 2181710 Covering Over Net Collections of Tax When the period of Limitations Has Expired - US. Schedule D line 13.

See also 11001-2c Example 5. Check Now If You Qualify. For more detailed information see the US.

Provide the caller with information requested per IRM 21510 Examination Issues. Refund Inquiries Section 5. NW IR-6526 Washington DC 20224.

A pre-1985 decree of divorce or separate maintenance or written separation agreement between the parents provides that the noncustodial parent can claim the child as a dependent and the noncustodial parent provides at least 600 for support of the child during 2021. Installment Agreement Request POPULAR FOR TAX PROS. Installment Agreement Request POPULAR FOR TAX PROS.

See Post-1984 and pre-2009 decree or agreement and Post-2008 decree or agreement. Find the latest business news on Wall Street jobs and the economy the housing market personal finance and money investments and much more on ABC News. The caller requests information on an Examination audit.

Extend the maximum age of eligible dependents from 12 to 13 for dependent care FSAs for the 2020 plan year and unused amounts from the 2020 plan year carried over into the 2021 plan year or for plans for which the end of the last regular enrollment period. Installment agreement extension to pay etc Transfer the call per specific guidance in paragraph 7 below. The total of the amounts on lines 4 and 13 of that Form 8606.

AmendFix Return Form 2848. However refunds may be subject to delay or used to pay down your tax debts. Ad Access IRS Tax Forms.

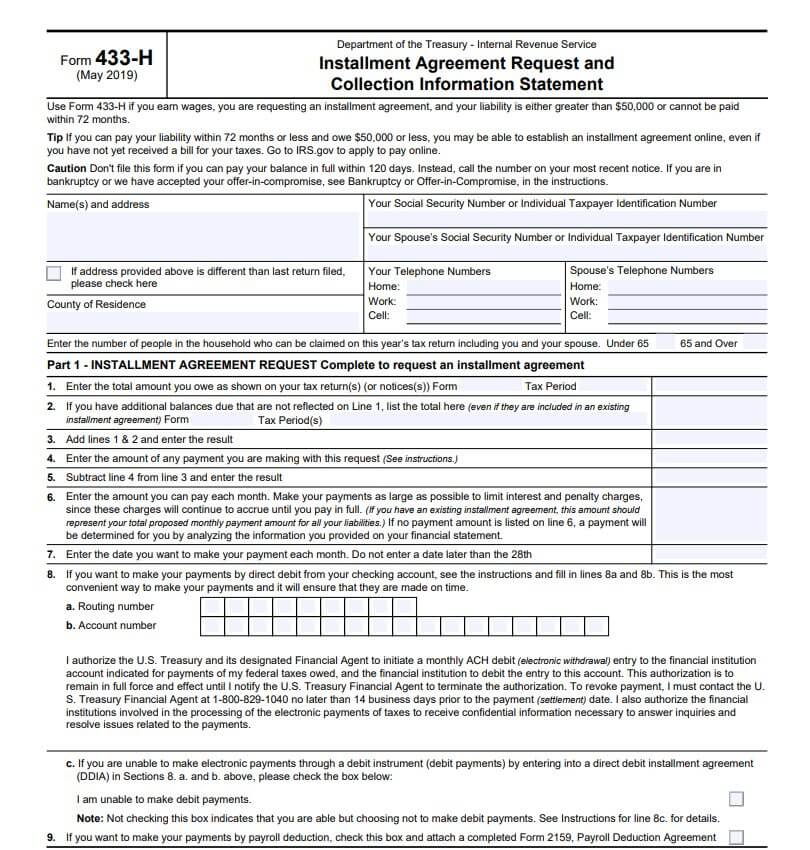

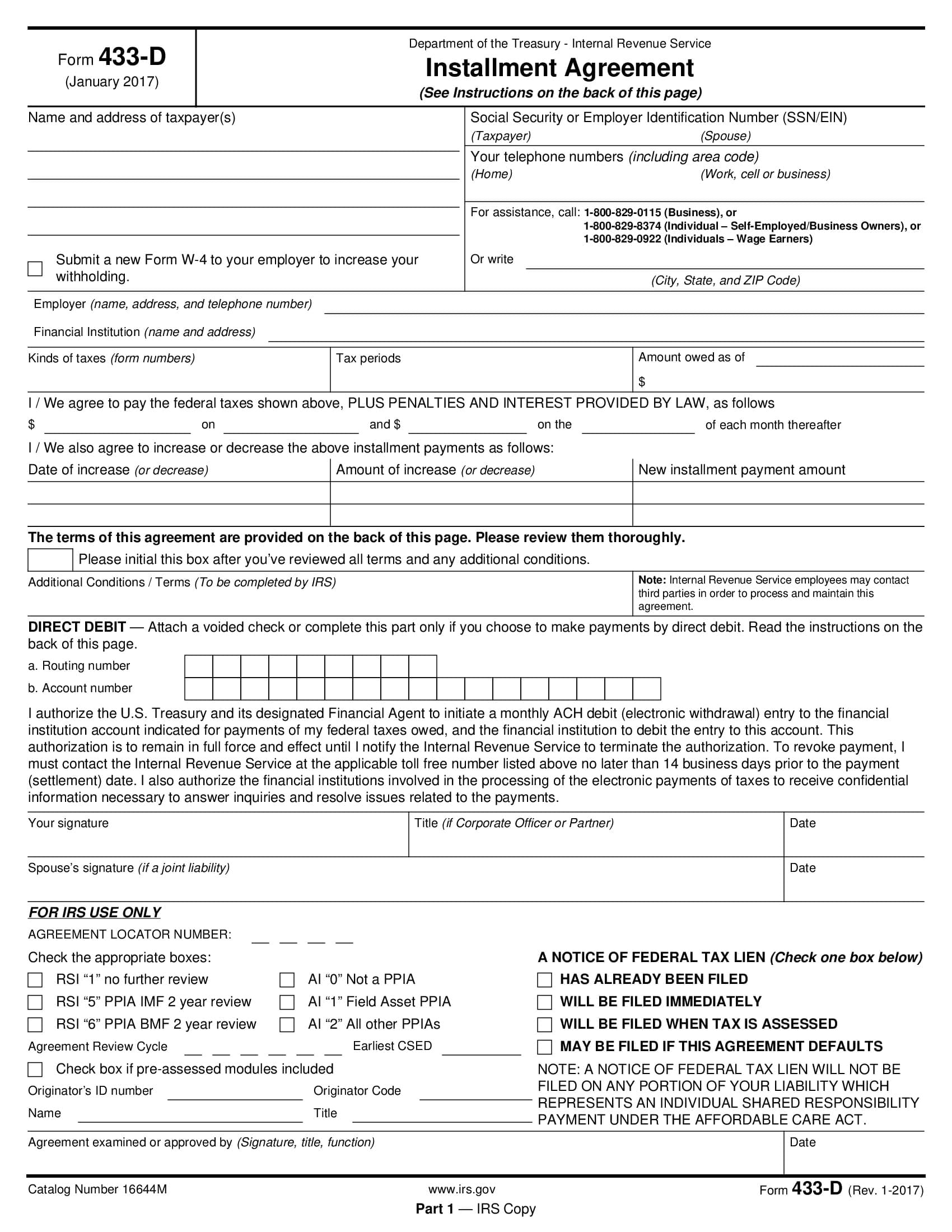

2141 Refund Research 21411 Program Scope and Objectives 214111 Background 214112 Purpose. Find basic information about Chapter 13 bankruptcy below. This chapter discusses the overall installment agreement process and considerations for whether to accept or reject an installment agreement proposal.

While the plan pays 100 percent of expenses incurred for covered benefits after satisfying the deductible the plan imposes a 10000 annual limit on. If you were a debtor in a chapter 11 bankruptcy case see Chapter 11 Bankruptcy Cases under Income in the Instructions for Form 1040. Installment Agreement Request POPULAR FOR TAX PROS.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Removed references to Californias recognition of oral agreements. IRM 5119 Collection Statute Expiration.

See the instructions of Form 1040 or 1040-SR Section 1250 1202 or collectibles gain Form 1099-DIV box 2b 2c or 2d. Modification as used in this subpart means a minor change in the details of a provision or clause that is specifically authorized by the FAR and does not alter the substance of the provision or clause see 52104. 5 Best Tax Relief Company Reviews of 2022.

2145 Erroneous Refunds Manual Transmittal. Ad You Dont Have to Face the IRS Alone. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less.

The caller requests a formal payment agreement ie. Complete Edit or Print Tax Forms Instantly. Request for Taxpayer Identification Number TIN and Certification.

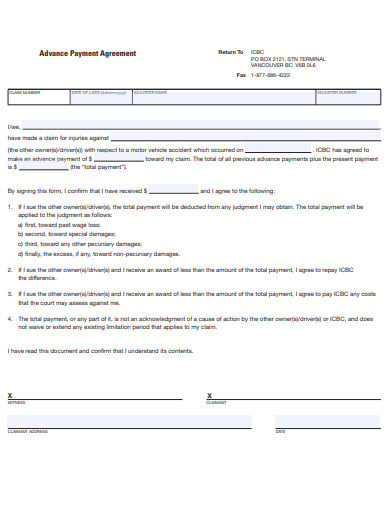

21 Payment Agreement Templates In Google Docs Pages Ms Word Pdf

Installment Agreement With Irs While In Chapter 13 Legal Answers Avvo

How To Set Up A Payment Plan With The Irs

I Am In Chapter 13 And I Owe Taxes That I Cannot Pay In One Lump Sum Can I Go Into An Installment Agreement With The Irs Legal Answers Avvo

If I File Bankruptcy Do I Still Have To Pay An Irs Installment Agreement Youtube

Irs Notice Cp523 Understanding Irs Notice Cp 523 Intent To Terminate Your Installment Agreement Seize Your Assets Pending

Cp521 Installment Agreement Payment Due

Success Stories Tabb Financial Services

Internet Media Solution

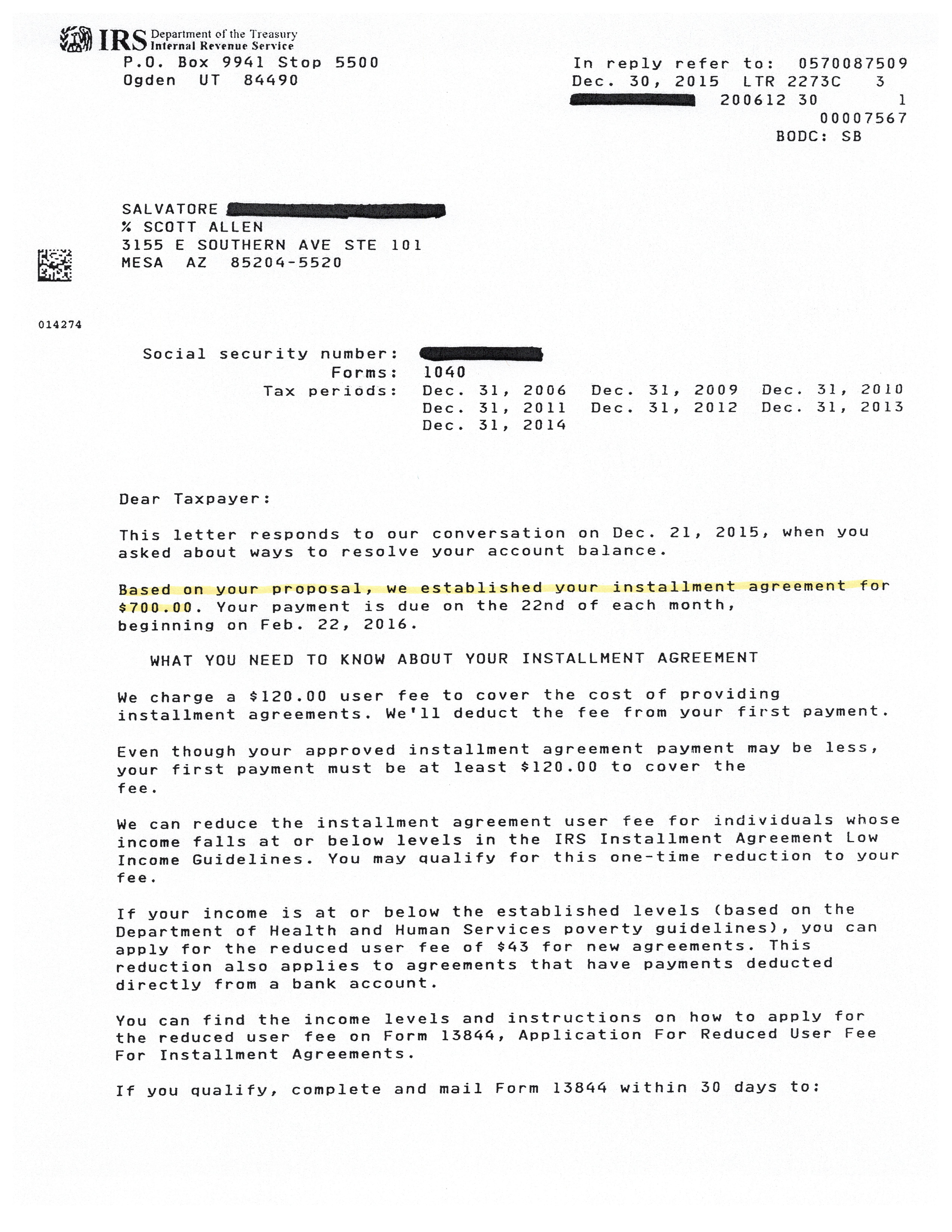

Sal And His Mesa Az Irs Installment Arrangement Tax Debt Advisors

Agenda City Of Santa Monica

Installment Agreement Tabb Financial Services

Installment Agreement Tabb Financial Services

Irs Installment Agreement Guide On Irs Payment Plans Supermoney

Installment Agreements Offer An Alternative To Bankruptcy Steinberg Enterprises Llc

New Jersey Irs Payment Plans Attorney Paladini Law Jersey City

New Jersey Irs Payment Plans Attorney Paladini Law Jersey City